With COVID-19 causing many full-time teachers to question their return to the classroom, another existing problem may be compounded—the shortage of substitute teachers. Before the pandemic, teacher absence rates were already on the rise, according to a new report¹ from the EdWeek Research Center, commissioned by Kelly Education—the school staffing division of Kelly Services. The report provides data collected from a survey of more than 2,000 principals, school district leaders, and school board members. Fifty-six percent of those surveyed said teacher absence rates are higher now than five years ago, and 71% of school administrators and board members see the demand for substitute teachers increasing in the next five years.

While our current economic downturn may provide employment opportunities for anyone qualified and interested in substitute teaching, their interest may decline when the economy recovers. To prevent talented substitutes from venturing into other lines of work, efforts to keep them engaged will be fundamental. The EdWeek Research Center/Kelly Education report suggested recruitment and retention incentives as a possible solution to augment the substitute teacher pool. Benefits such as health insurance and retirement plans are every bit as important as salary when an employee is deciding whether to stay or go.

Fortunately, substitute teachers tend to fall into the category of “part-time, seasonal, and temporary”, and there is an IRS-approved retirement benefit designed specifically for this category of workers. The FICA Alternative Plan is a type of 3121 retirement plan that replaces Social Security.* Employers avoid the matching 6.2% Social Security contribution, replacing it with an impactful benefit for employees. With a 3121 plan, 7.5% of an employee’s wages are contributed pre-tax to the plan, resulting in a contribution nearly equal to the 6.2% they would have otherwise paid to Social Security, because of the pre-tax scenario. Funds are invested with the potential to grow over time and the account balance with earnings is tax-deferred until distribution upon eligibility.

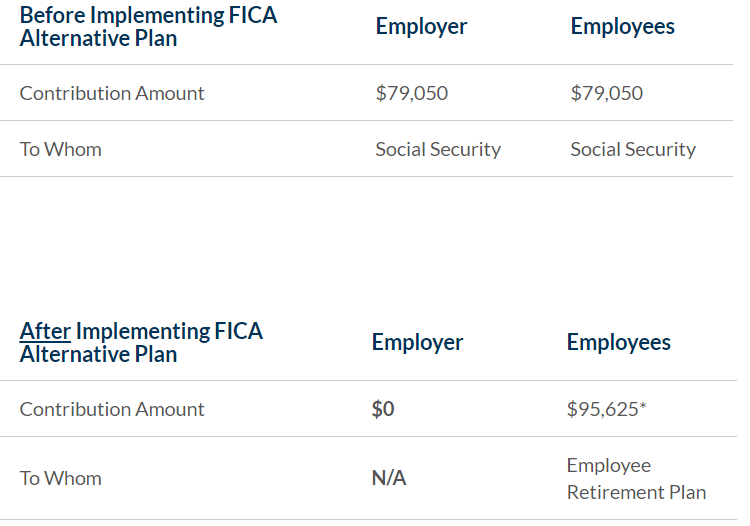

Estimated Savings with a FICA Alternative Plan

The chart below illustrates the potential savings that could be realized, assuming an average annual salary of $8500 per part-time, seasonal, or temporary employee, based on 150 participants. (Total $1,275,000)

Savings for the employer: $79,050

The employer is able to keep the savings or allocate it among plan participants.

*It may appear that employees have less take-home pay, but the next chart illustrates why that’s not the case.

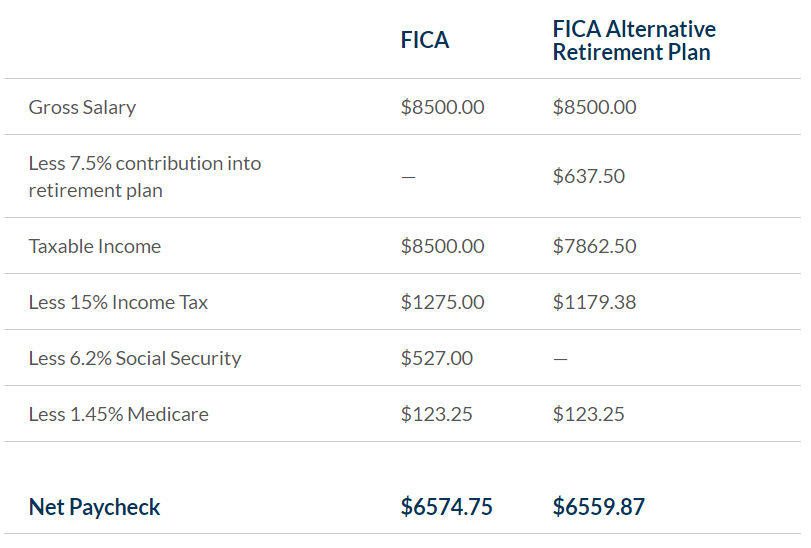

How 7.5% Equals 6.2%

Employer after-tax Social Security contributions of 6.2% are replaced with pre-tax employee contributions of 7.5% into a FICA Alternative retirement plan, to potentially grow over time. This actually leaves employees with around the same take-home pay as contributing to Social Security would. Why? Because FICA Alternative Plan contributions are pre-tax.

Attracting and retaining talented school employees is especially important in these trying times. It’s equally important to help those intent on retiring find the right path to get there. There are tax-advantaged options to help employees prepare their nest eggs for the future as well as transition those individuals ready to retire now.

¹The Substitute Teacher Gap – Recruitment and Retention Challenges in the Age of Covid-19

*The FICA Alternative Plan may not be permitted in all states. To request more information, please complete the form below.