A Special Pay Plan (a type of 403(b) or 401(a) retirement plan) is a simple, cost-effective retirement plan that benefits both the employer and the employee. Designed to handle special forms of compensation like unused sick leave or vacation pay, funds are contributed pre-tax into the participant’s retirement account upon their retirement or separation of service.

The following benefits of a Special Pay Plan illustrate how employers could enhance their current benefits package while saving them money:

How an Employer Benefits from a Special Pay Plan

- Tax Savings

Employers avoid 7.65% in FICA taxes that they would have otherwise paid if they did not place the funds in a Special Pay Plan. - Unique Funding

Special Pay Plans are funded using unique forms of compensation like unused sick and vacation leave. Payments may also be based on years of service and severance. - Recruitment & Retention Tool

Contributions into the retiree’s plan are made pre-tax, providing the full, untaxed value of the unused compensation. Funds are invested with the potential to grow as well, which means there’s potential to increase account value over time. This creates an impactful retirement benefit that can help employers attract and retain talent.

How a Special Pay Plan Can Supplement a Health Reimbursement Arrangement (HRA)

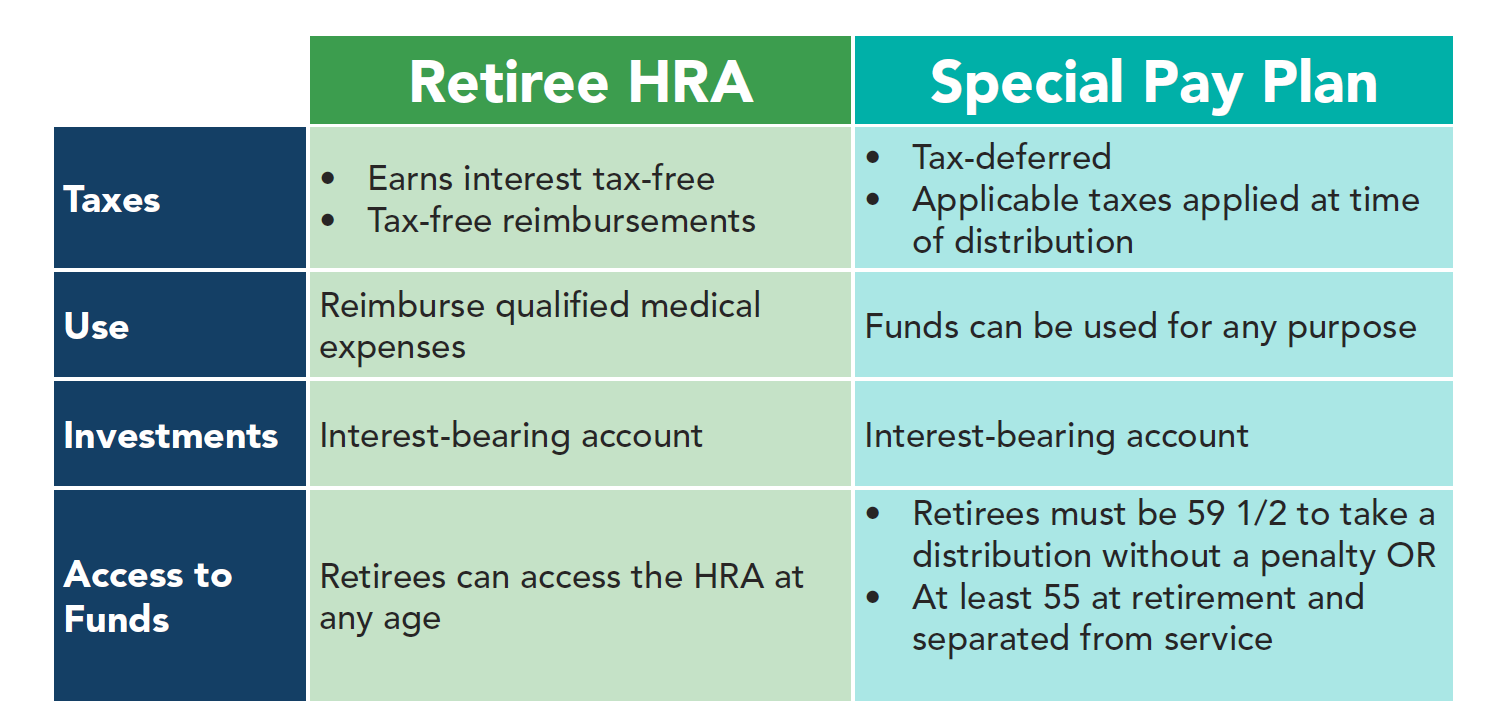

Employers who currently offer an HRA to their retirees can provide an added benefit to their retirement package by implementing a Special Pay Plan. HRA funds must be used to pay for eligible medical expenses. A Special Pay Plan can supplement that post-retirement income by providing access to money that can be used for any purpose once the retiree has reached the distribution eligibility age*. This means an employer could potentially place unused sick leave into an HRA and the unused vacation pay into a Special Pay Plan, creating two buckets of post-retirement funds for the retiree. Both plans utilize an investment vehicle for potential growth.

Special Pay Plan/HRA Comparison Chart

* Special Pay funds are eligible for distribution once the participant has reached age 55 and separated from service.

Stay Connected!

Sign up for our mailing list below.