Public sector employers regularly provide valuable work opportunities for part-time, seasonal and temporary employees. Although some of these employees may not participate in their employer’s benefits, part-time, seasonal, and temporary workers have been able to take part in Social Security. However, many public sector employers don’t realize that they have an opportunity for cost savings.

So how can public sector employers reduce their cost while providing a valuable benefit? MidAmerica’s 3121 FICA Alternative Plan is a type of retirement plan for public sector part-time, seasonal and temporary workers that replaces Social Security. Ultimately, it’s a cost saver for employers and a valuable benefit for part-time employees.

By saving money in their own operational budget, employers have the power to reinvest savings back into their organization, ultimately resulting in more satisfied employees, a higher retention rate, and benefits that attract quality talent.

Here’s how it works.

The 3121 FICA Alternative Plan eliminates the 6.2% Social Security contribution by the employee and match by the employer. Instead it routes 7.5% of employees’ before-tax wages into an interest-bearing retirement plan, creating a win-win arrangement for everyone. Due to the pre-tax nature of their contribution, the employee’s paycheck remains virtually unchanged and their eligibility for Medicare is unaffected.

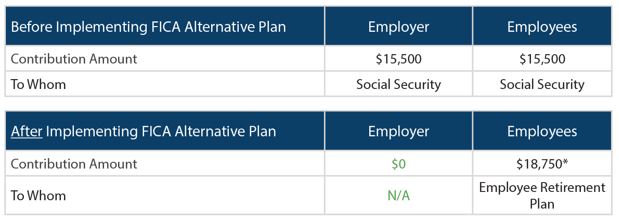

This chart shows the savings realized by an employer whose payroll for part-time, seasonal, and temporary employees totals $250,000:

*It may appear that employees have less take-home pay, but the chart below illustrates why that’s not the case.

Savings for the employer: $15,500

How 7.5% equals 6.2%

Even though employees are replacing their 6.2% Social Security contribution with a 7.5% contribution into their 3121 FICA Alternative Plan, they are actually left with around the same take-home pay. Why? Because FICA Alternative Plan contributions are pre-tax. The chart below illustrates the magic of how 7.5% equals 6.2%.

Who’s qualified for 3121 FICA Alternative Plans?

Eligible employers are either governmental entities that are are closely affiliated with state and local governments (generally by government ownership or control), or a political subdivision, which is a separate legal entity of a state that usually has specific governmental functions. Your state Social Security administrator can advise you on the status of your organization.

At the end of the day, the 3121 FICA Alternative Plan is a cost-effective retirement benefit for part-time, seasonal, and temporary employees. But the employer isn’t the only one reaping the benefits of this plan—employees truly benefit, too. For them, 7.5% of wages are contributed on a pre-tax basis, while their take-home pay remains virtually unchanged. Funds are also invested, adding a potential for earnings on contributions over time. Investments may even be self-directed to meet personal retirement goals.

In a world of reduced budgets despite rising retirement costs, truly impactful retirement benefits make employees feel secure and valued. By implementing a 3121 FICA Alternative Plan, employers can ensure their compensation structure remains attractive to potential and existing talent.

Is a 3121 FICA Alternative Plan right for your organization?

Schedule a free consultation: