Posted on November 20, 2020

If you’re not familiar with Health Reimbursement Arrangements (HRAs), the details of this powerful benefit may seem complicated at first glance. If your employer provides an HRA, we’re here to help you not only understand this cost-effective solution, but also give you the tools you need to take full advantage of it. So whether you’re brand new to the plan or simply need a refresher, below are some key highlights and need-to-know details of the HRA.

What is an HRA?

Simply put, an HRA is a triple tax-free account used to reimburse eligible medical expenses incurred by you, your spouse or any eligible dependent. Account contributions, interest accrual, and reimbursements are always 100% tax-free (hence, triple tax-free). The account, depending on plan design, can be used to pay for a wide range of eligible medical expenses, such as prescriptions, doctor’s visits, and premiums. Funds are provided entirely by the employer, and the account can be designed to never expire. MidAmerica has been administering HRAs since their introduction by the Internal Revenue Service (IRS) in 2002, offering years of experience in handling all compliance and administration in-house for clients across the country.

Why an HRA?

You may wonder why you need an HRA or perhaps why it’s considered such a valuable benefit. What it boils down to is that health care costs—both before and after retirement—are on the rise. Data shows that health care during retirement is expensive and increasing across the country. Multiple studies have revealed that the average couple retiring at 65 could need more than $388,000* to cover lifetime health care costs. Couples retiring before 65 are estimated to need $15,490 per year** to cover costs until they reach Medicare eligibility. What’s more, health care costs are only increasing. Health care expenditure as a share of US GDP has skyrocketed from 13% in 2000 to 18% in 2018 and is projected to hit 20% by 2028.*** Given these numbers, it is imperative employers provide their employees with health care stability in retirement. An HRA offers an effective solution to this health care cost dilemma. By committing funds to a triple tax-free account, an employer slashes the burden of medical expenses for their employees in retirement. As the experiences of thousands of MidAmerica clients and participants across the country can attest to, an HRA is a great way to satisfy health expenses and save money in retirement.

How does it work?

One of the defining features of an HRA is the incredible plan flexibility it allows. The details of the plan can vary depending on the needs of the client, so we always encourage plan participants to refer to their Plan Highlights**** if they have questions. However, there are certain elements that are true of all HRAs:

- Enrollment is automatic.

When an employer implements an HRA, all eligible employees are automatically enrolled in the plan.

- HRAs are 100% funded by the employer.

With an HRA, all funds are always contributed by the employer, so that the participant’s paycheck is untouched. Employers can use anything from accrued sick and vacation leave to additional incentives to fund a participant’s account.

- HRAs are always triple tax-free.

As mentioned before, these funds enter and exit the account tax-free. These tax savings include avoiding the 7.65% FICA tax for employers and employees. HRAs are invested for potential tax-free growth with either a minimum guaranteed rate of return or, if applicable, in variable investments. Once a participant is claims eligible, they can start using the funds to reimburse eligible medical expenses on a tax-free basis. This includes reimbursements for their spouse and eligible dependents, who can exhaust the account in the event of the participant’s passing.

HRA vs. HSA: Understanding the differences.

You may find yourself confusing HRAs with Health Savings Accounts (HSAs), another tax-free benefit vehicle used to reimburse eligible medical expenses. These two benefits can be easily mistaken for each other and while there are many similarities between the two, there are some key differences worth noting. While offering the same tax savings as an HRA, an HSA is more limited in its applications and flexibility. For example, an HSA can only be used in conjunction with an HSA-qualifying High Deductible Health Plan (HDHP). Additionally, an employee with an HSA cannot be covered by their own or their spouse’s Flexible Spending Account (FSA) unless it is limited to vision and dental only. An HRA, meanwhile, can be used in conjunction with any insurance or benefit plan as determined by your employer. An HRA is also unlike an HSA in that an HRA has no annual contribution limit and can only be contributed to by the employer. An HSA can receive contribution from an employee’s paycheck and has an annual limit of only $3,550 for individuals and $7,100 for families (as of 2020). Finally, an HSA is limited in the types of reimbursements it covers. While both HRAs and HSAs cover Medicare Part B and D as well as vision and dental premiums, HSAs do not cover premiums for health insurance, nor do they cover Medicare supplemental insurance. Although both plans offer savings to their plan participants, an HRA offers the plan flexibility and scope of coverage that an HSA simply cannot provide. To learn even more about the differences and similarities between these two benefits, click here.

Best-in-Class Service

If you still have questions about your HRA or need additional resources, MidAmerica’s Participant Services team is here to help. We provide nationwide coverage for participant education, ensuring you understand how to manage and access your benefit. Simply call (855) 329-0095 Monday through Thursday from 8:30 a.m.–8:00 p.m. ET and Friday from 8:30 a.m.–6:00 p.m. ET. You can also reach us by email at [email protected].

*HealthView Services – “The nation’s leading producer of healthcare cost-projection software.” 2019 Retirement Healthcare Brief.

**MEPS – The Medical Expenditure Panel Survey – Health Care Costs/Expenditures.

***CMS.gov – Centers for Medicare and Medicaid Services – National Health Expenditure Historical and Projections 1960-2028.

****A copy of your Plan Highlights is mailed to you, along with a detailed Welcome Kit, upon your employer’s initial contribution to the plan.

Posted on November 18, 2020

Tampa, FL – MidAmerica Administrative & Retirement Solutions, LLC (MidAmerica), is proud to announce that Ryan Murphy has joined our company as Vice President of Finance. Ryan brings deep financial and operational experience to his new role leading MidAmerica’s Finance and Accounting team. Ryan is responsible for developing business and financial forecasts while proactively managing the financial health of the business. He will focus on streamlining operational processes, driving a culture of high performance and continuous improvement that values quality and the client experience. Additionally, he will lead corporate initiatives and manage MidAmerica’s annual budgeting process.

“As MidAmerica continues to grow, it is important that we have cross-functional alignment on every level,” said Jim Tormey, MidAmerica’s President and Chief Executive Officer (CEO). “The addition of Ryan rounds out our executive team, and I am absolutely thrilled to welcome him aboard.”

Prior to joining MidAmerica, Ryan served as Vice President of Finance and Corporate Controller for Transflo (Pegasus Transtech, LLC), a private equity-backed provider of technology solutions for the transportation industry. In this role, Ryan prepared financial and management reporting for the executive team and Board of Directors. He also provided oversight and guidance to a team responsible for accounting, billing and collections, and worked closely with the CFO and the Financial Planning & Analysis (FP&A) team on annual budget, monthly forecast updates and financial modeling. In addition, Ryan coordinated preparation and filing for all federal, state and local tax returns, including K-1’s and the annual financial statement audit.

Ryan holds a Bachelor of Business Administration from the University of Notre Dame as well as a Master of Business Administration from the University of Florida and is an active Certified Public Account (CPA).

About MidAmerica Administrative & Retirement Solutions, LLC

MidAmerica was established in 1995 to take care of those who do so much to take care of our communities. For more than 25 years, MidAmerica has served public sector employers and their employees by providing impactful solutions for some of their toughest issues: rising health care costs, high post-employment liabilities, and attracting/retaining talent.

Currently serving more than half a million public sector employees across the country, MidAmerica is one of the nation’s leading providers of FICA Alternative and Special Pay Plans, Health Reimbursement Arrangements, Flexible Spending Accounts, and Trusts. To learn more about MidAmerica, visit www.myMidAmerica.com.

Posted on November 16, 2020

Dedicated public sector employees often accumulate a substantial amount of vacation time, sick leave, and other retirement incentives over the course of their careers. This accumulation adds up to what may seem like a sizable cash payout once the employee makes the leap into retirement; however, it can also amount to a significant tax liability for that individual—and for their employer as well. While cash payouts are often standard protocol for retiring public sector employees, these perceived “cash windfalls” may not set them up for the secure retirement they had envisioned and earned.

Factors That Are Overlooked

Payroll compensation is subject to FICA and Medicare withholding up to 7.65% for both employee and employer, which means large cash payouts at the time of retirement have tax ramifications for both parties. Additionally, the employee will pay federal income tax on the gross payout. For the sake of example, let’s assume an employee is entitled to a lump sum of $40,000 at retirement and they’re in a tax bracket of 22%.* The employer will be on the hook for $3,060 in FICA and Medicare taxes. The employee will be subject to the same $3,060 in FICA and Medicare taxes, plus federal income tax of $8,800. The $40,000 lump sum has just been reduced to $28,140. That can be quite a blow to a retiree’s sense of security.

Heading into retirement, a well-prepared public sector employee will have done all the math— that is, they’ve calculated their assets and savings (such as pension benefits, accumulated leave payout, and projected Social Security earnings) and compared them to their spending plan. However, during employment, the major share of their health insurance cost was likely paid by their employer. As a result, they can easily overlook planning for this expense in retirement and may not be prepared for what their health insurance will cost without the benefit of employer-subsidized coverage. On average, single retirees pay a monthly premium of $650.** Those who haven’t reached the Medicare eligibility age of 65 will be facing significant out-of-pocket health insurance costs. For them, bridging the gap between retirement and Medicare is imperative.

Two Powerful Solutions

Fortunately, there are tax-advantaged alternative benefit plans that can reduce, and even eliminate, the blow of a hefty tax bill. There are two options widely used among public sector agencies that are each powerful alone, but even better when paired together—the Special Pay Plan and the Health Reimbursement Arrangement (HRA).

Special Pay Plan

With a Special Pay Plan, accumulated leave and other retirement incentive payouts are tax-deferred, eliminating the 7.65% FICA and Medicare taxes for both employer and employee. The funds have the potential for investment growth—tax-deferred—and do not incur federal, state, or local income taxes until they are withdrawn. Once withdrawn, the funds can be used for any purpose. Further, a retiree may be in a lower tax bracket by the time they withdraw their funds, which would mean a lower tax liability than the hypothetical 22% referenced earlier.

Health Reimbursement Arrangement (HRA)

Like the Special Pay Plan, the HRA also allows accumulated leave to be paid out in a tax-advantaged manner. HRA funds are used to pay for qualified medical expenses, as determined by the Internal Revenue Service (IRS). With the HRA, the employee receives a triple tax benefit:

- Funds are deposited into the HRA by the employer free of FICA and Medicare taxes (up to 7.65%).

- Earnings on invested HRA funds are untaxed.

- Reimbursement of eligible medical expenses, including health insurance premiums if applicable, are completely tax-free.

As an added benefit, the HRA can be used by the participant, their spouse, and any eligible dependents. The HRA is a tax-efficient vehicle that maximizes the retiree’s ability to pay for health care, thereby bridging the gap between retirement and Medicare eligibility.

A Winning Combination

While the Special Pay Plan and the HRA are valuable benefit options in and of themselves, the value is augmented when the two work in concert. A benefit program can be designed to divert accumulated leave payouts into two different buckets—Special Pay and HRA—and the allocation percentage can be determined by the employer and/or bargaining group. The result is a “best of both worlds” scenario with tax-deferred funds that can be used for anything and tax-free funds to pay for health care.

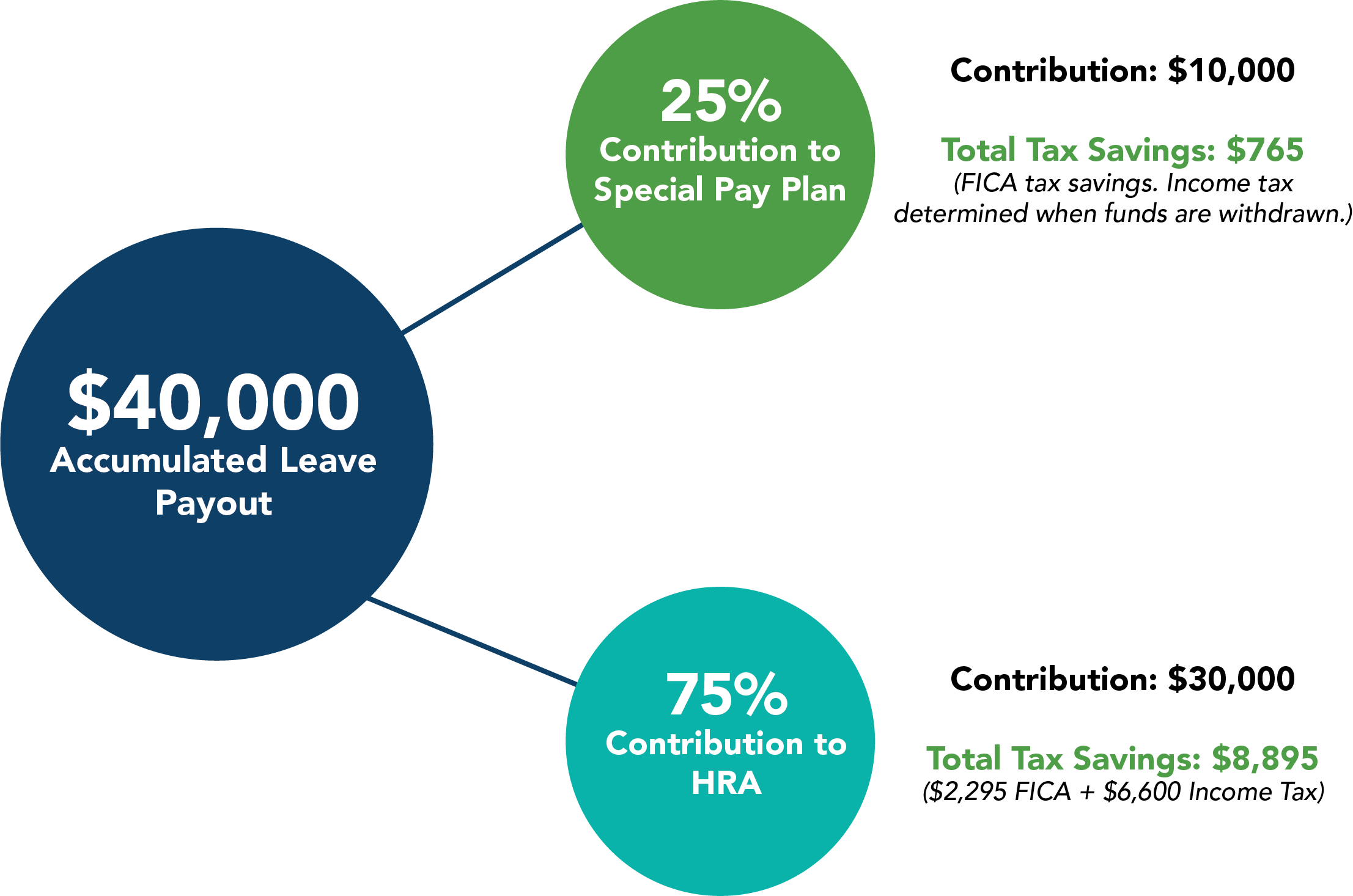

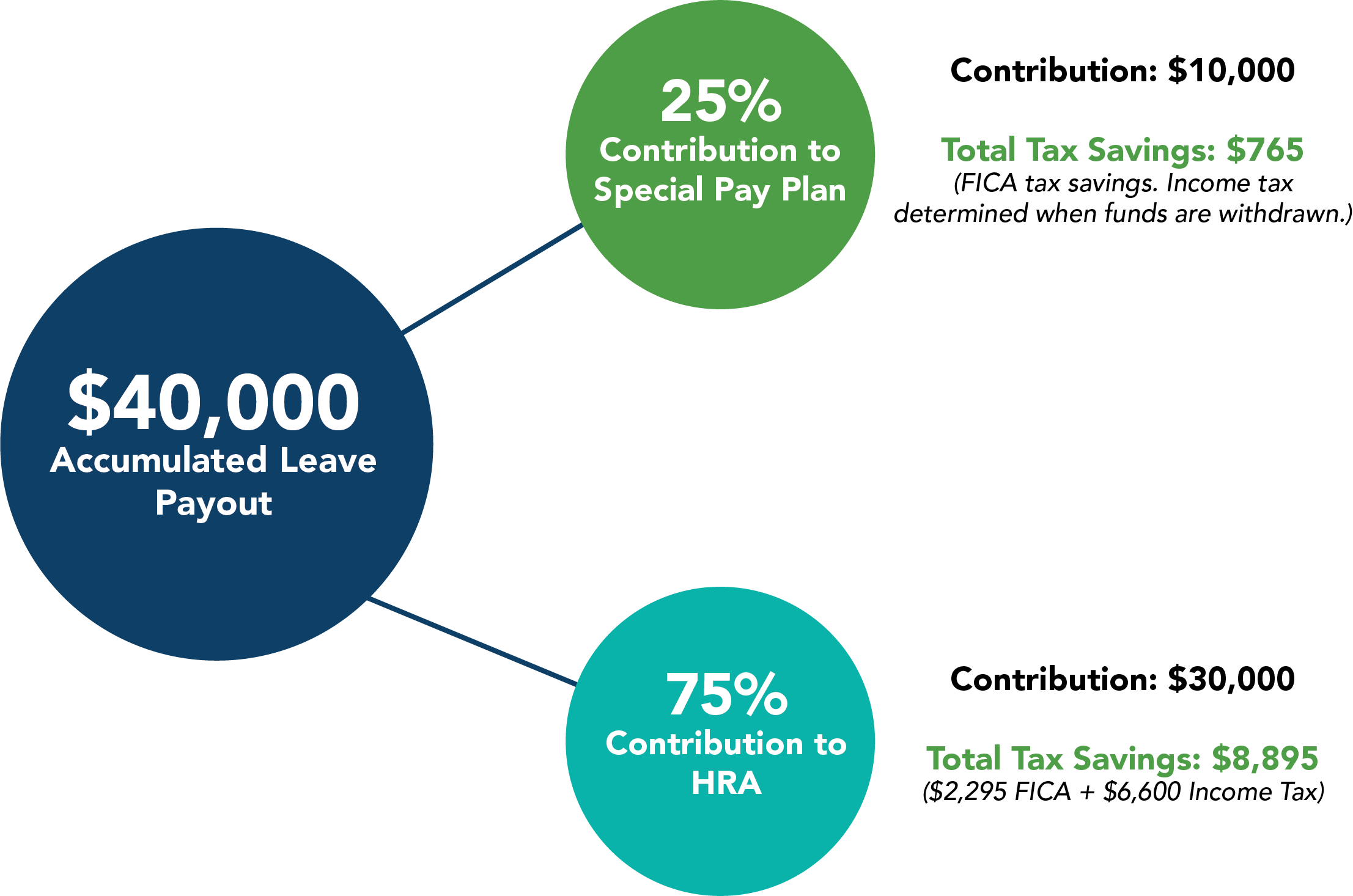

To demonstrate just how a Special Pay/HRA combination would benefit a retiree, let’s use the $40,000 lump sum payout in another example. If 25% of that $40,000 were diverted to a Special Pay Plan, the retiree would have $10,000 available for use upon age eligibility with taxes deferred until the time of withdrawal. If the other 75% of the $40,000 payout were placed into an HRA, the retiree would have $30,000 to pay for eligible medical expenses with a $0 tax liability.

The diagram above illustrates an immediate tax reduction of $9,660 across both plans. A deposit of $30,000 into an HRA would enable a retiree to pay for 46 months of health insurance, based on an average premium of $650 per month.

The Special Pay Plan and the HRA are simple to understand, easy to implement, and highly impactful in terms of maximizing employer savings, stretching retiree dollars, and leveraging tax-advantaged opportunities to realize a healthy, financially secure retirement.

Download our Accumulated Leave Case Study!

Want to learn even more about alternative ways to pay out accumulated leave once an employee retires? Download our case study!

*Based on an average salary at retirement of $60,000. Consult your tax advisor for the actual tax rate that would apply to you.

**2019 average single retiree premium (MidAmerica survey)

Posted on November 4, 2020

The Internal Revenue Service (IRS) recently released the 2021 annual contribution limits for Health Flexible Spending Accounts as well as IRC Section 403(b) and Section 457(b) plans.

Health Flexible Spending Accounts

The annual limit on voluntary employee salary reductions for contributions to a health flexible spending account will be $2,750 in 2021, which remains unchanged from 2020.

| Health Flexible Spending Accounts Contribution Limits |

| Tax Year |

Annual Limit |

| 2021 |

$2,750 |

| 2020 |

$2,750 |

| 2019 |

$2,700 |

For more information on Health FSA limits, review Revenue Procedure 2020-45.

403(b) Retirement Plans

The annual salary deferral limit will be $19,500 in 2021, which remains unchanged from 2020.

The following limits will also remain unchanged in 2021:

- If you qualify for the full amount of the lifetime catch-up, the catch-up contribution limit remains unchanged at $3,000. This brings the annual total limit for employees who qualify for the lifetime catch-up to $22,500.

- The catch-up contribution limit for employees who are age 50 or over remains unchanged at $6,500. This brings the annual total limit for employees who qualify for the age 50+ catch-up to $26,000.

| 403(b) Plan Contribution Limits |

| Tax Year |

Basic Deferral Limit for All Employees |

Annual Limit if you Qualify for the Full Amount of the Lifetime Catch-Up (15 Years of Service). Total Lifetime Catch-Up Max of $15,000 |

Annual Limit if You Qualify for the Age 50+ Catch-Up |

Maximum Annual Contribution if You Qualify for Both the Age 50+ and Lifetime Catch-Ups |

| 2021 |

$19,500 |

$22,500 |

$26,000 |

$29,000 |

| 2020 |

$19,500 |

$22,500 |

$26,000 |

$29,000 |

| 2019 |

$19,000 |

$22,000 |

$25,000 |

$28,000 |

For more information on the current 403(b) limits, review the IRS article, Income Ranges for Determining IRA Eligibility Change for 2021.

457(b) Retirement Plans

The annual salary deferral limit will be $19,500 in 2021, which remains unchanged from 2020.

The following limits will also remain unchanged in 2021:

- The catch-up contribution limit for employees who are age 50 or over remains unchanged at $6,500. This brings the annual total limit for employees who qualify for the age 50+ catch-up to $26,000.

| 457(b) Plan Contribution Limits |

| Tax Year |

Basic Deferral Limit for All Employees |

Annual Limit if You Qualify for the Age 50+ Catch-Up |

| 2021 |

$19,500 |

$26,000 |

| 2020 |

$19,500 |

$26,000 |

| 2019 |

$19,000 |

$25,000 |

For more information on the current 457(b) limits, review the IRS article, Income Ranges for Determining IRA Eligibility Change for 2021.

Questions?

We’re here to help. If you have questions about the recent IRS updates or the impact they may have on your plan, call us at (800) 430-7999 or email us at [email protected].

Posted on October 30, 2020

This year, the COVID-19 pandemic pushed industries into unprecedented territory—moving many public sector organizations into a fully remote environment for the first time ever. We understand that budgetary constraints, retention challenges and employee morale have weighed heavily on HR professionals as they’ve navigated this new normal, and it may make the upcoming open enrollment season seem more daunting than ever.

However, open enrollment—even in a fully remote environment—doesn’t have to be yet another obstacle for you to overcome in 2020. With consistent, clear messaging and a thoughtful game plan, public sector organizations can host a successful open enrollment. Here are some tips from our team of HR experts for making this year’s enrollment season a win-win for both you and your employees.

Lean into tried-and-true remote communication methods.

Perhaps you’ve relied on desk drops or in-person meetings in the past to drum up awareness of benefit enrollment periods. In a remote world, digital communications may be easier to produce and disperse, and by now, you may have already established a tried-and-true way of connecting with your remote workers. Continue to leverage the methods your employees are familiar with, whether it’s weekly emails, internal newsletters or notifications from your payroll and benefits platform. Including open enrollment information in communication vehicles employees are already accustomed to seeing increases the likelihood of engagement.

Create an online repository for benefit information.

Think of using your company’s intranet as a place to house and highlight important open enrollment information such as upcoming deadlines, links to benefit administrator and vendor websites, benefit FAQs and essential forms, or any helpful videos and webinar recordings. Hosting information through a website or mobile app grants employees 24/7 access to the benefit details they need to make an informed decision and is another powerful resource you can leverage in a remote working environment.

Host virtual town halls, live webinars, etc.

The key to communicating benefit information is making sure that your employees have room to ask questions and engage with the material being presented. By hosting virtual town halls or live webinars, you can encourage employee engagement by creating a space to answer their questions and address any concerns. Be sure to get creative—consider organizing a virtual benefits fair and invite guest speakers from your benefit administrators to educate employees on their options. In fact, our experts regularly lend their guidance and expertise at these sessions to help employees understand the benefits our clients offer through MidAmerica. We suggest hosting multiple sessions at separate times and recording them—this covers all bases and ensures anyone can view the sessions at their own convenience, including those who may have missed it or new hires.

Make sure to plan ahead.

Our team of HR experts stress the importance of planning open enrollment and any education sessions ahead of time to cast the widest net possible—as well as beginning the open enrollment process one to two weeks before any HR-driven deadlines. We recommend socializing your open enrollment timeline well in advance—with frequent reminders—so enrollment stays top of mind for employees as critical dates and virtual education sessions draw near.

Proactively reach out to employees who may have a record of enrolling late.

If you know certain employees have struggled in the past with enrolling, take the time and effort to reach out to these individuals on a one-to-one basis. See if they have begun considering this season’s open enrollment process or if they have any questions that may be easier answered in this personal setting. Our HR experts say that this type of excellent customer service may be just the ticket to helping all employees successfully cross the enrollment finish line.

How MidAmerica Can Help.

Still looking for more tips and tricks? Check out this additional MidAmerica article that lays out ideas such as starting education early, remembering the basics, communicating your plan and level of coverage and more. We want you to feel empowered moving into this season and are more than happy to support you through these trying times. We offer many tools and resources you can use to help employees better understand voluntary benefits, like their Flexible Spending Account (FSA), and how to take advantage of it. If you have any questions regarding your FSA open enrollment, please reach out to [email protected].

Overall, the goal is to keep employees interested in what their benefits offer and what’s new to help them get the most out of their plans. By utilizing some of the above tips, you are sure to have a successful open enrollment season.

Posted on October 14, 2020

Written by Jim Tormey | President & CEO

To say 2020 brought a set of unexpected challenges to the public sector would be an understatement. As the year continues to unfold and the Coronavirus pandemic continues to evolve, we understand the pressure and toll it’s taking—especially on you, the clients we serve.

We founded our business in 1995 to support the public sector, providing guidance and solutions to help you face some of your toughest challenges. We were there for you then and, more than ever, we’re here for you now as we hold true to one of our MidAmerica Core Values: We Take Care of our Customers.

As classrooms reopen, as cities make tough calls on mask ordinances and shut-downs, and as we all remain focused on the wellbeing of those we love, please let me offer a heartfelt THANK YOU for everything you’re doing to keep our communities safe.

Teachers, city workers, public safety employees and countless other public sector workers have faced unprecedented adversity this year yet continue to show up each and every day in service to our communities. Their selfless example fuels and inspires us, and reaffirms our steadfast commitment to being there for you through it all.

Whether you need help retaining employees, are facing seemingly insurmountable budget challenges, or just need advice—we’re here to talk, to listen and to problem solve. We see the incredible work you’re doing every day for our schools, colleges, cities, and communities, and we’re grateful and proud to support you as a trusted partner every step of the way.

Thank you from the MidAmerica team for keeping our worlds moving forward. We’re in this together!

Sincerely,

Jim Tormey

We’re here to help.

If you or your participants have questions or need support during this time, we’re here for you. Our hours have not changed and we’re still accessible via phone or email.

Participant Service Hours

Monday through Thursday

8:30 a.m.–8:00 p.m. ET

Friday

8:30 a.m.–6:00 p.m. ET

Phone: (800) 430-7999 | [email protected]

For employer-level service, contact your Account Manager by emailing [email protected].

Posted on October 13, 2020

When it comes to providing employees with a comprehensive health benefit plan, it’s important for the employer to consider all parties involved. Some employees may be open to a change in benefits, while others will undoubtedly be hesitant. Every employee has a unique financial situation that will sway his or her opinion, but MidAmerica has found that through candid conversations between decision makers and employees, a win-win arrangement is achievable.

Since the IRS approved the use of the Health Reimbursement Arrangement (HRA) in 2002, MidAmerica has helped public sector employers across the country save on FICA taxes, reduce their OPEB liability, and help employees offset the cost of rising health care. Despite the increasing adoption of the HRA and the recognition of both its cost-saving abilities and administrative flexibility, employees may be hesitant to accept it as a new benefit due to some common misconceptions. If you currently offer an HRA or if you’re looking to implement an HRA for your organization, we understand that getting your employees on board is a large part of the process. Below are some common concerns employees, unions and bargaining groups may have and tips on how to help them understand the long-term benefit of the HRA solution:

Employee Concern: “I don’t need my unused leave for medical expenses—I want to use that money for any purpose I want after I retire.”

Employer Response: “The average 65-year-old couple retiring in 2019 can expect to spend $285,000 in health care and medical expenses throughout retirement[1], which means that without an HRA, you will likely use a tax-deferred retirement benefit or cash payout to cover these expenses. An HRA allows that money to be invested for potential tax-free growth and used tax-free when you incur the inevitable medical costs. Plus, we can set up a unique plan design so that a portion of your unused leave is placed into an HRA while the remaining funds are placed into a tax-deferred retirement plan, like a 401(a) or 403(b) plan, to be used for any purpose you choose. Essentially, you’ll maximize the value of your unused leave to help offset the rising costs of health care in retirement.”

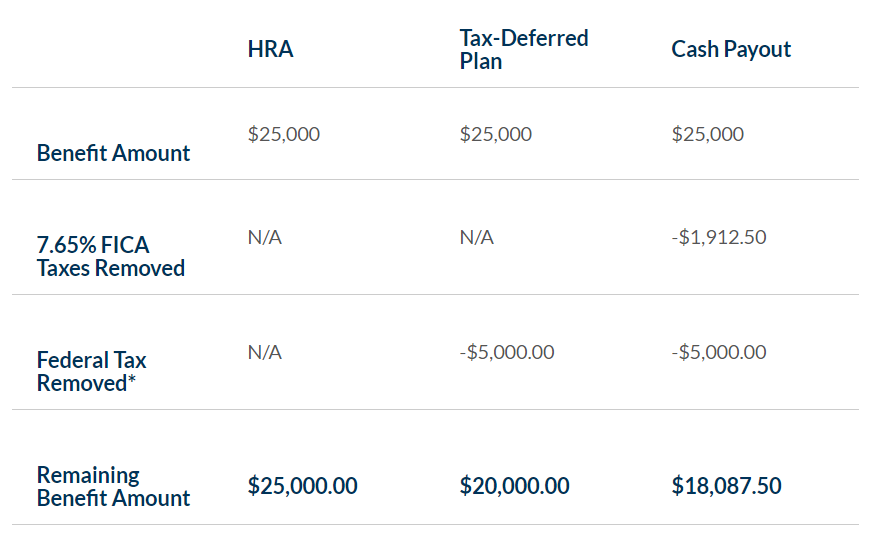

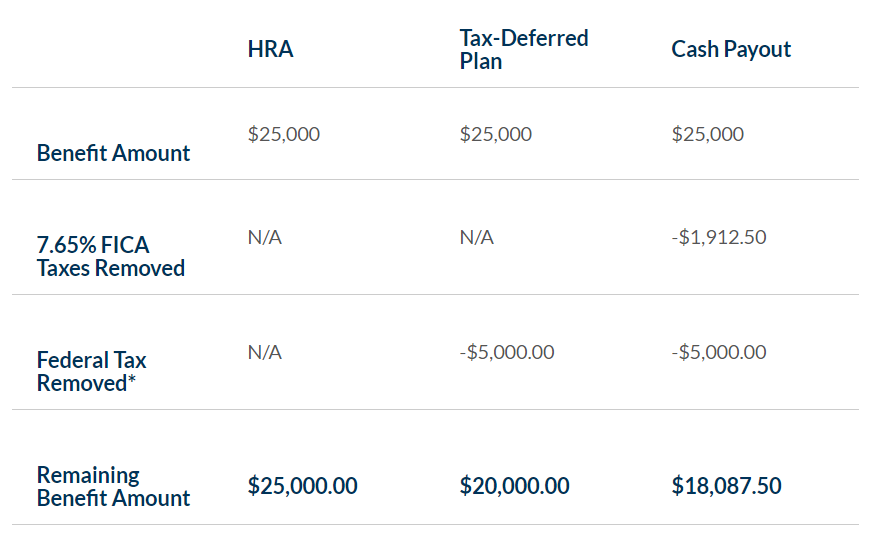

Employee Concern: “It seems like I’m losing money since I’m not receiving a cash benefit.”

Employer Response: “You’re actually receiving more money since the HRA is tax-free! This means you receive dollar for dollar the benefit amount you are promised. Unlike other retirement plans, the money reimbursed through the HRA is not subject to FICA, Federal, or State income taxes. With an HRA, deposits, accumulation, and reimbursements are all tax-free. In fact, you can easily calculate how much of your total benefit you’d receive based on the benefit vehicle.” Below is an illustration based on a $25,000 benefit amount.

*Based on 20% Federal Tax assumption. Consult your tax advisor for the actual tax rate that would apply to you.

*Based on 20% Federal Tax assumption. Consult your tax advisor for the actual tax rate that would apply to you.

Employee Concern: “Is it true that HRAs do not allow beneficiaries?”

Employer Response: “A participant’s surviving spouse, tax dependents, and qualifying children can still access HRA funds to pay for their own qualifying medical expenses after a participant’s death. Most participants fully spend their HRA balances over the course of their lifetimes.”

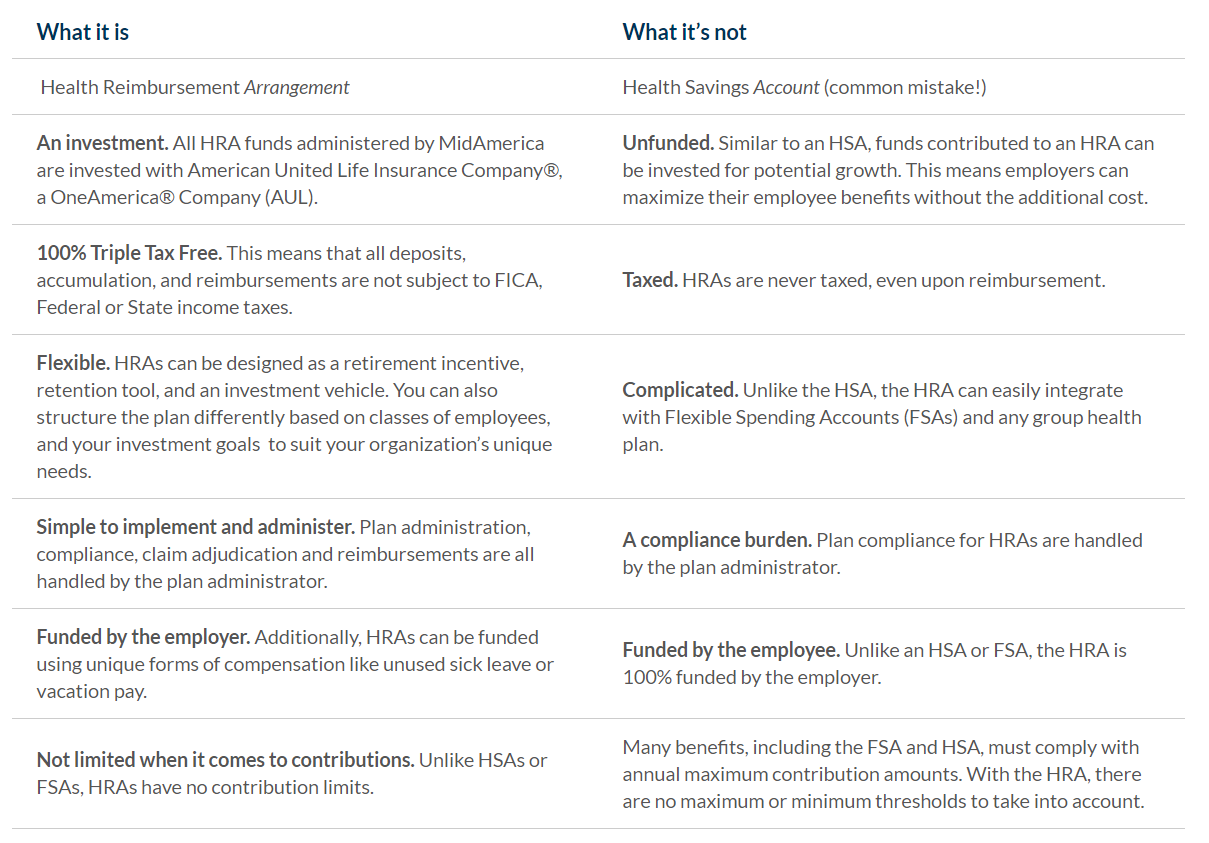

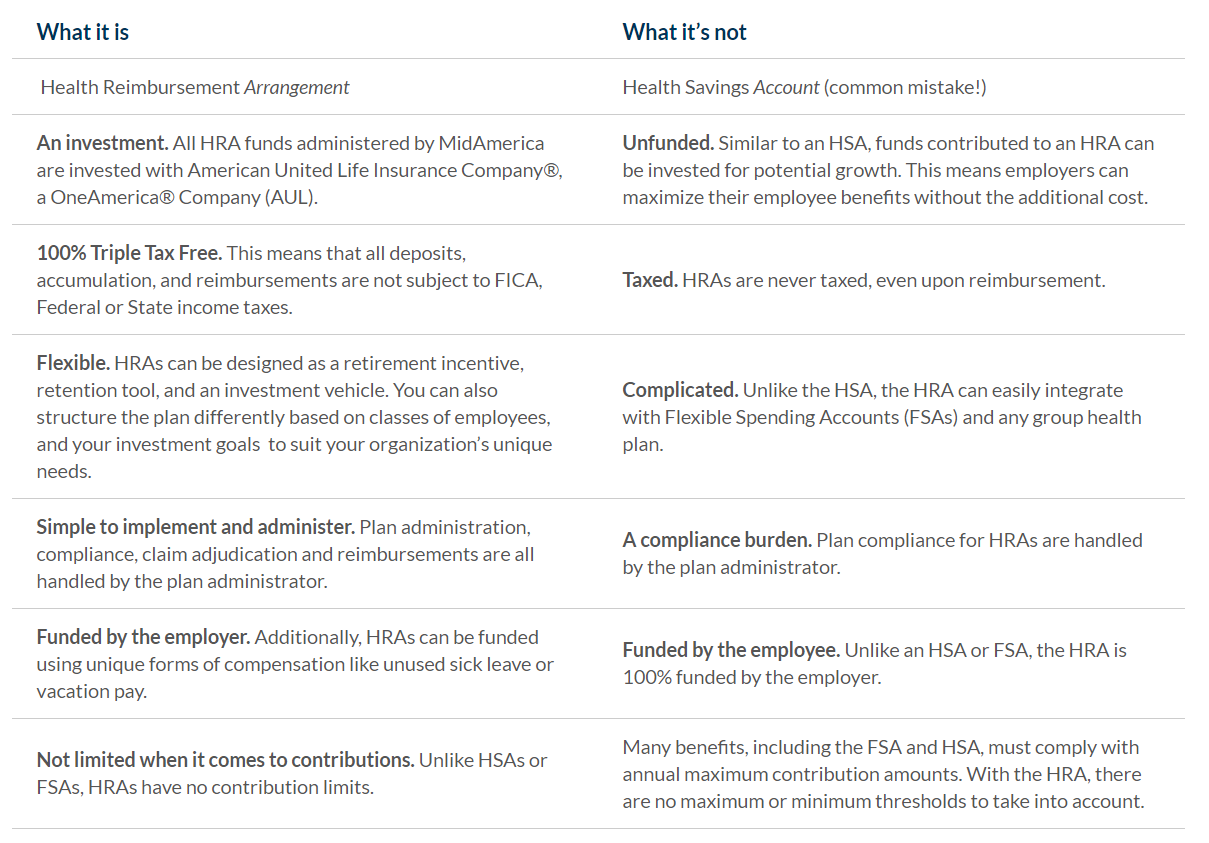

Other Common Misconceptions: What an HRA Is, And What It’s Not

No matter if you need help explaining your current HRA to your participants, or if you’re interested in implementing one, we’re here to help. MidAmerica can work with you to create a plan design that meets your unique needs and will assist in discussions about this valuable benefit. Simply reach out to your Account Representative or Account Manager to request additional details or to arrange a consultation.

If you’d like to learn more about the HRA, simply complete the form below!

[1] https://www.investopedia.com/retirement/how-plan-medical-expenses-retirement/

*Based on 20% Federal Tax assumption. Consult your tax advisor for the actual tax rate that would apply to you.

*Based on 20% Federal Tax assumption. Consult your tax advisor for the actual tax rate that would apply to you.