Posted on September 9, 2020

Senior-level employees like police and fire chiefs, department heads, and city managers often have hundreds (and sometimes thousands) of hours in accumulated leave time on the city ledger. Such is the nature of these professionals, who are often highly compensated, dedicated employees who are long-tenured and rarely take significant time off. So what happens when these employees decide to retire or leave to accept a position with another public agency? Cities are unexpectedly hit with the liability of paying out large banks of leave hours—and too often, management finds that their budget is not prepared for payouts of this magnitude. This liability not only can crush an organization’s budget, but must also be reported annually as compensated absence, adding to the city’s overall unfunded liabilities. This can be viewed negatively by credit rating agencies when assessing the city’s creditworthiness.

It’s no secret that the public sector is facing a significant crisis in its effort to keep up with escalating pension and retiree health care costs. State and local governments are increasingly finding themselves saddled with huge unfunded liabilities.

- On average, government employees leave 21 percent of their PTO unused.

- In 2013, there were 24 million government workers, accounting for 13 percent of total jobs. The public sector accounts for 25 percent of all unused days of PTO, or 106 million days, because government workers tend to earn more PTO and leave more days unused.*

- Nationwide, payouts for untaken time off have rocketed upward by nearly 80 percent since 2008.**

- In 2017, California paid out six-figure sums to about 460 employees, up from 280 in 2012.

Despite the seemingly insurmountable challenge at hand, fiscal sustainability can be readily achieved through an accrued leave conversion plan, which is an innovative way to increase budget predictability, reduce or even remove liabilities of accrued leave payouts, and decrease administrative burden.

Here’s how it works

Unused compensated employee absences (vacation, holiday, and sick days for example) are deposited into a tax-deferred 401(a) plan, a tax-free Health Reimbursement Arrangement, or a combination of the two. This transfers the value of leave bank dollars, and therefore management of those funds, to the employee while allowing for potential growth. The plan is funded (typically annually) with the current unused leave balance, avoiding payouts at a potentially higher pay rate down the line and eliminating the risk of large payouts upon separation or retirement. And as an ancillary benefit, the plan ultimately allows a city to have more certainty when reporting their annual liabilities.

Simply put, it’s a win-win for both the employer and employee.

If you’re interested in learning more about accrued leave liability solutions, simply reach out to accountmanagement@myMidAmerica.com.

Sources:

*Oxford Economics, “An Assessment of Paid Time Off in the U.S.: Implications for employees, companies, and the economy,” (February 2014).

**Steven Malanga, “Debts No Honest State Can Pay,” (March 25, 2019)

Posted on August 18, 2020

With COVID-19 causing many full-time teachers to question their return to the classroom, another existing problem may be compounded—the shortage of substitute teachers. Before the pandemic, teacher absence rates were already on the rise, according to a new report¹ from the EdWeek Research Center, commissioned by Kelly Education—the school staffing division of Kelly Services. The report provides data collected from a survey of more than 2,000 principals, school district leaders, and school board members. Fifty-six percent of those surveyed said teacher absence rates are higher now than five years ago, and 71% of school administrators and board members see the demand for substitute teachers increasing in the next five years.

While our current economic downturn may provide employment opportunities for anyone qualified and interested in substitute teaching, their interest may decline when the economy recovers. To prevent talented substitutes from venturing into other lines of work, efforts to keep them engaged will be fundamental. The EdWeek Research Center/Kelly Education report suggested recruitment and retention incentives as a possible solution to augment the substitute teacher pool. Benefits such as health insurance and retirement plans are every bit as important as salary when an employee is deciding whether to stay or go.

Fortunately, substitute teachers tend to fall into the category of “part-time, seasonal, and temporary”, and there is an IRS-approved retirement benefit designed specifically for this category of workers. The FICA Alternative Plan is a type of 3121 retirement plan that replaces Social Security.* Employers avoid the matching 6.2% Social Security contribution, replacing it with an impactful benefit for employees. With a 3121 plan, 7.5% of an employee’s wages are contributed pre-tax to the plan, resulting in a contribution nearly equal to the 6.2% they would have otherwise paid to Social Security, because of the pre-tax scenario. Funds are invested with the potential to grow over time and the account balance with earnings is tax-deferred until distribution upon eligibility.

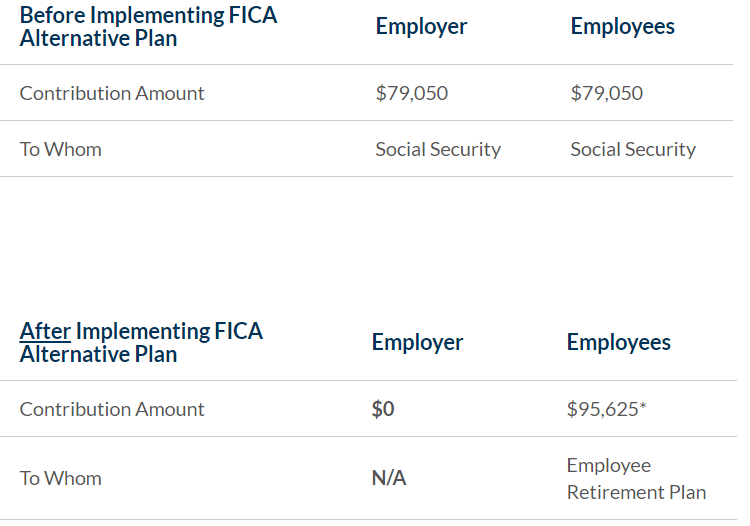

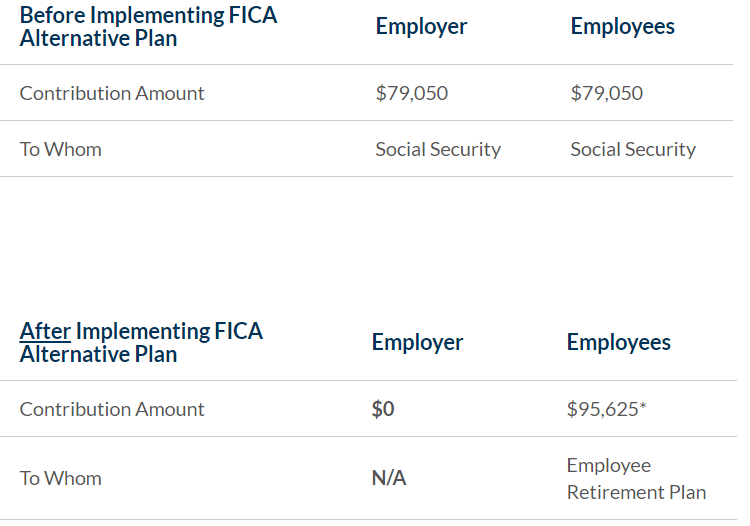

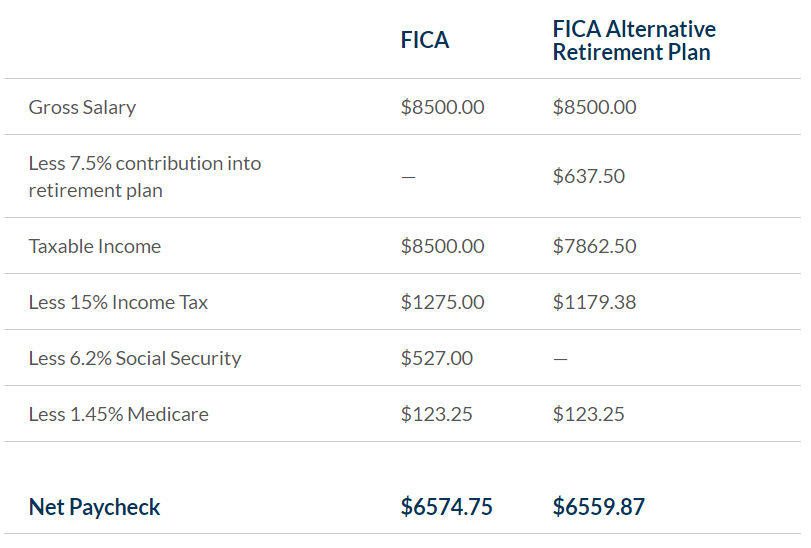

Estimated Savings with a FICA Alternative Plan

The chart below illustrates the potential savings that could be realized, assuming an average annual salary of $8500 per part-time, seasonal, or temporary employee, based on 150 participants. (Total $1,275,000)

Savings for the employer: $79,050

The employer is able to keep the savings or allocate it among plan participants.

*It may appear that employees have less take-home pay, but the next chart illustrates why that’s not the case.

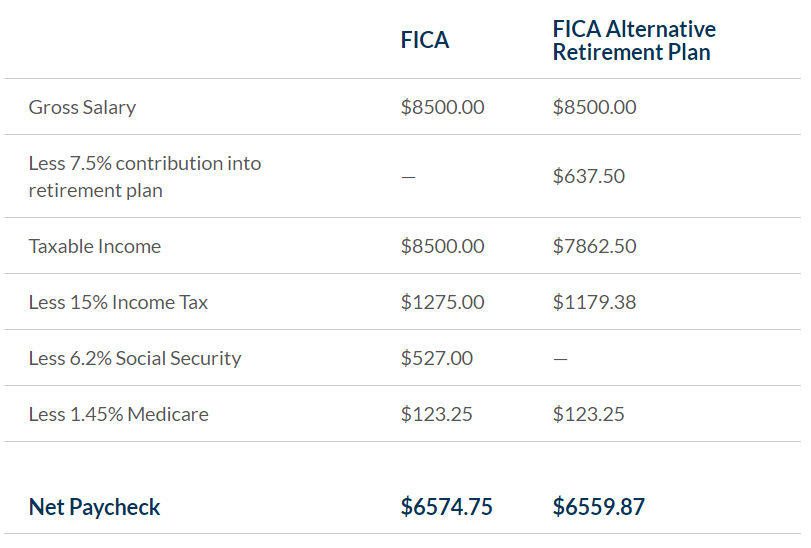

How 7.5% Equals 6.2%

Employer after-tax Social Security contributions of 6.2% are replaced with pre-tax employee contributions of 7.5% into a FICA Alternative retirement plan, to potentially grow over time. This actually leaves employees with around the same take-home pay as contributing to Social Security would. Why? Because FICA Alternative Plan contributions are pre-tax.

Attracting and retaining talented school employees is especially important in these trying times. It’s equally important to help those intent on retiring find the right path to get there. There are tax-advantaged options to help employees prepare their nest eggs for the future as well as transition those individuals ready to retire now.

¹The Substitute Teacher Gap – Recruitment and Retention Challenges in the Age of Covid-19

*The FICA Alternative Plan may not be permitted in all states. To request more information, please complete the form below.

Posted on August 10, 2020

The outbreak of COVID-19 has presented unprecedented challenges this year, around the world and here in America. With the new school year rapidly approaching—or in some cases, already starting—one of the most looming questions is how we safely send students and education-related employees back to school. As school districts work quickly to address these concerns and ensure students, employees, and the families of these individuals are kept safe, these districts are also staring down unwanted reductions in their workforce.

In a recent CNN article, several teachers expressed their misgivings about what the new school term will bring. The article features Sarah Gross, a 37-year old high school English teacher in New Jersey, who admits to CNN that she is eager for schools to reopen in the fall but adds, “I think a lot of times people forget that kids don’t go to school by themselves. The schools are run by a lot of adults, and a lot of those adults are especially vulnerable to coronavirus.” Gross said she’s not only worried about teachers but also bus drivers, lunch aids, and secretaries.

The Current Situation

Since more than one quarter of public schoolteachers are over the age of 50*, the fear is understandable. According to a USA Today/Ipsos online poll, nearly 1 in 5 teachers surveyed said they are not likely to return to work if schools reopen in the fall. For those age 55 and over, in most cases representing those teachers with many years of experience, 1 in 4 said they probably will not return. These figures suggest that school districts will potentially see a substantial amount of resignations. Another potential issue is a shortage in substitute teachers—if teachers resign or become sick, the need for temporary replacements will grow, exacerbating an existing challenge.

Schools have always struggled with employees leaving to pursue higher pay and advancements, but the COVID-19 pandemic may increase unwanted attrition. The voluntary reduction in force is most likely to be seen among: teachers with compromised immune systems or those over age 60 because they fear the health risks; teachers reluctant to adapt to the online classroom scenario; and those experiencing overall reduction in job satisfaction. However, there are creative solutions to help offset any large-scale workforce reductions.

Understanding Your Options

Offering a targeted retention incentive in the form of a defined contribution benefit can encourage employees to continue working AND provide a reason for jobseekers to choose one district over another. A defined contribution plan can be more attractive than a retirement-based defined benefit because employees can see the contributions they are receiving while they are actively working. Additionally, plan factors such as vesting schedules can be applied to persuade employees to remain with the district until they are fully vested in their benefit.

A Triple Tax-Free Defined Contribution Benefit

The Defined Contribution Health Reimbursement Arrangement, or dcHRA, is a type of defined contribution benefit that provides a tax-free way to pay for eligible medical expenses (including premiums) upon retirement or separation of service. Funded by the employer while the employee is actively working, funds are invested for potential tax-free growth, which can potentially increase the benefit value over time. With health care costs continuing to rise, a tax-free way to pay for the inevitable medical expenses during retirement can further incentivize employee retention. Funds can be used tax-free upon retirement or separation of service by the employee, their spouse and eligible dependents.

While the current health crisis is far from over, there are hopeful possibilities for school employees and employers. School districts have access to a valuable benefit option in the dcHRA, as it attracts talent and serves as a retention tool. School districts can even use accumulated leave as a funding mechanism for the dcHRA benefit. With its triple tax-free features (tax-free contributions, growth, and reimbursements), the dcHRA is a win-win for both employees and employers.

To learn more about reducing unwanted attrition, click here.

* Results from the 2017-18 National Teacher and Principal Survey published by the National Center for Education Statistics

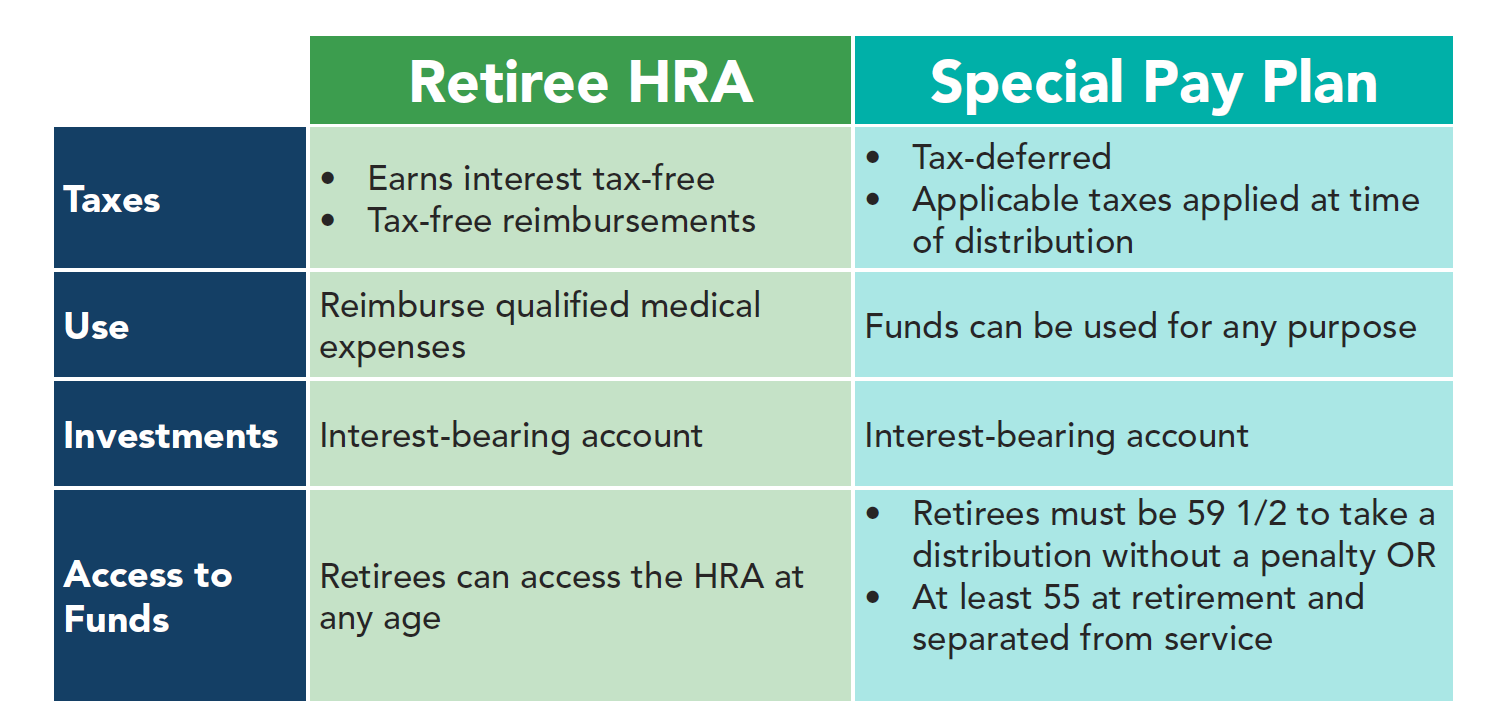

A Special Pay Plan (a type of 403(b) or 401(a) retirement plan) is a simple, cost-effective retirement plan that benefits both the employer and the employee. Designed to handle special forms of compensation like unused sick leave or vacation pay, funds are contributed pre-tax into the participant’s retirement account upon their retirement or separation of service.

The following benefits of a Special Pay Plan illustrate how employers could enhance their current benefits package while saving them money:

How an Employer Benefits from a Special Pay Plan

- Tax Savings

Employers avoid 7.65% in FICA taxes that they would have otherwise paid if they did not place the funds in a Special Pay Plan.

- Unique Funding

Special Pay Plans are funded using unique forms of compensation like unused sick and vacation leave. Payments may also be based on years of service and severance.

- Recruitment & Retention Tool

Contributions into the retiree’s plan are made pre-tax, providing the full, untaxed value of the unused compensation. Funds are invested with the potential to grow as well, which means there’s potential to increase account value over time. This creates an impactful retirement benefit that can help employers attract and retain talent.

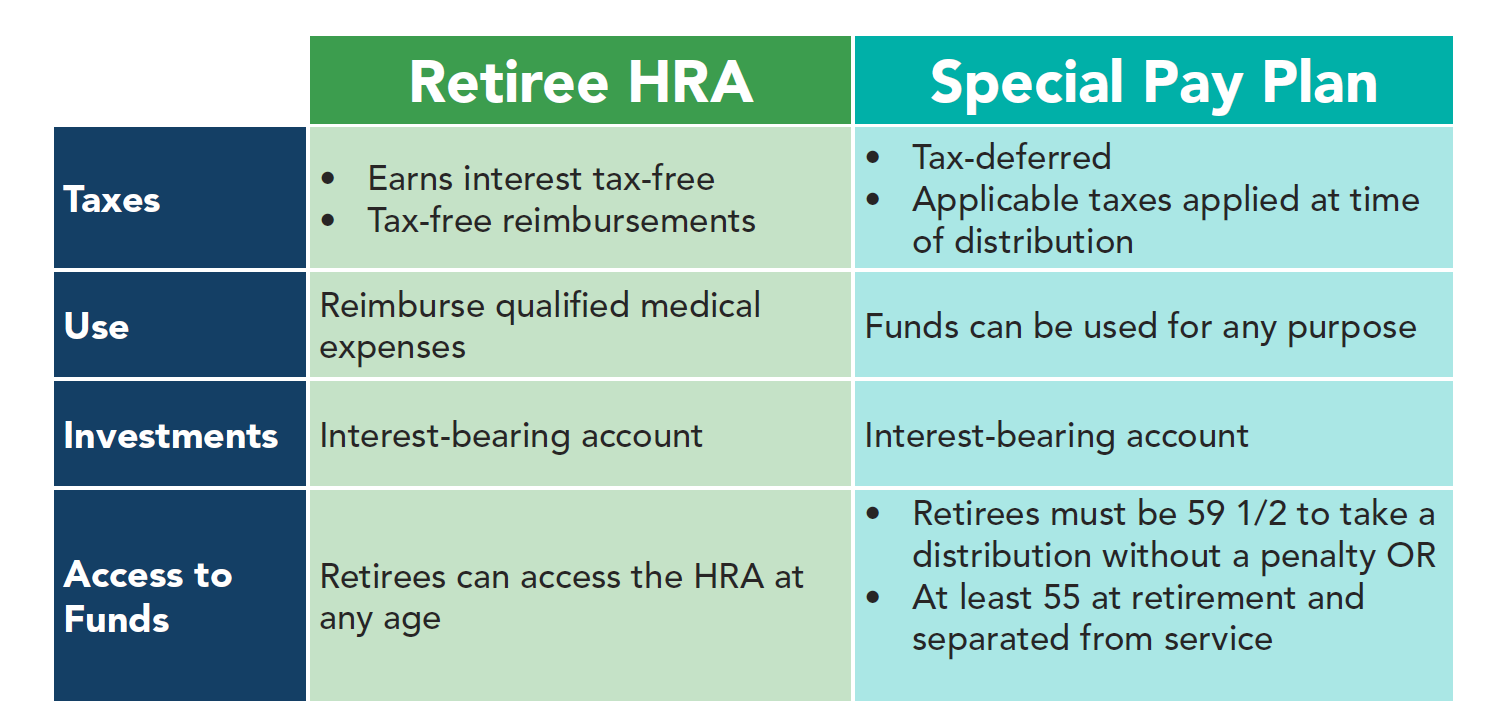

Employers who currently offer an HRA to their retirees can provide an added benefit to their retirement package by implementing a Special Pay Plan. HRA funds must be used to pay for eligible medical expenses. A Special Pay Plan can supplement that post-retirement income by providing access to money that can be used for any purpose once the retiree has reached the distribution eligibility age*. This means an employer could potentially place unused sick leave into an HRA and the unused vacation pay into a Special Pay Plan, creating two buckets of post-retirement funds for the retiree. Both plans utilize an investment vehicle for potential growth.

Special Pay Plan/HRA Comparison Chart

* Special Pay funds are eligible for distribution once the participant has reached age 55 and separated from service.

Stay Connected!

Sign up for our mailing list below.

In late June, the IRS released Notice 2020-50, which offers an expanded definition on who is qualified to take advantage of the CARES Act provisions relating to retirement plan* distributions and plan loans. This expanded definition seeks to provide further relief to those affected by COVID-19.

As expanded under Notice 2020-50, a qualified individual is anyone who:

- is diagnosed, or whose spouse or dependent is diagnosed, with the virus SARS-CoV-2 or the coronavirus disease 2019 (collectively, “COVID-19”) by a test approved by the Centers for Disease Control and Prevention (including a test authorized under the Federal Food, Drug, and Cosmetic Act); or

- experiences adverse financial consequences as a result of the individual, the individual’s spouse, or a member of the individual’s household (that is, someone who shares the individual’s principal residence):

- being quarantined, being furloughed or laid off, or having work hours reduced due to COVID-19;

- being unable to work due to lack of child care due to COVID-19;

- closing or reducing hours of a business that they own or operate due to COVID-19;

- having pay or self-employment income reduced due to COVID-19; or

- having a job offer rescinded or start date for a job delayed due to COVID-19.

Notice 2020-50 also provides further clarification on plan loan amounts and repayment terms administration:

- Suspension period only applies to payments due between March 27, 2020 and December 31, 2020.

- Loan payments delinquent prior to these dates are not covered by the CARES Act.

- All loan payments must resume after the end of the suspension period—no later than January 1, 2021.

- The loan can be re-amortized to reflect a final payment/due date with a new due date—not to exceed one year after the original loan terms.

- Loan payment suspension is only available to qualified individuals and requires a signed self-certification form.

Additional Resources

To stay up to date regarding COVID-19 related items, check out our CARES Act Resources page.

Important note: Money Purchase Plan (MPP) funds do not qualify for CARES Act relief.

*These updates impact MidAmerica Special Pay, 3121 FICA Alternative, APPLE, Employer Sponsored or Single Vendor plans.

By Trent Teesdale, CEBS | Senior Vice President of Business Development

The outbreak of Coronavirus early in the year caused employers across the globe massive and unforeseen challenges. Following the announcement of the global pandemic, school districts and municipalities were forced to quickly respond by shutting down offices, parks, classrooms and other public spaces to maintain social distancing recommendations. We understand that many entities have had to utilize already limited funding to invest in technology, training, and safety equipment during this time—all while keeping our community resources and public education running smoothly. This expansion of services using the same—or in some cases, less—fiscal resources have many public entities turning to layoffs in order to alleviate the financial burden.

On the other side of the spectrum, some organizations are faced with an increase of attrition due to the fear employees may have about returning to a physical work environment as public spaces slowly begin to reopen.

So how do we combat the cost of mass layoffs (both financially and through a loss of resources) and avoid losing too much of the workforce at once due to attrition?

Avoiding Mass Layoffs through a Strategic Buyout Strategy

Unlike the private sector, local governmental entities rely heavily on employees to keep operations running smoothly, as opposed to technology or process enhancements. Since payroll expenses usually account for 60% of a public sector employer’s operational costs, mass layoffs may seem like a logical step to take to reduce spending. However, layoffs in and of themselves can prove to be pricey and should be a last resort—especially when the majority of employees are involved in bargaining or union groups that often contractually require the least senior employees be laid off first. This means that employers would need to reduce their workforce by twice as much to achieve the same financial relief as perhaps laying off a more tenured employee. Knowing this, you can structure your benefits in a way that creates a win-win arrangement for all. Below is a readily available option.

Offer an Early Retirement Incentive

Creating retirement incentives for those who are close to retirement or eligible for retirement is a mutually beneficial way to reduce your workforce without the added cost of paying for unemployment. Oftentimes employees are hesitant to retire before age 65 because they cannot afford health insurance prior to Medicare eligibility. A Retiree Health Reimbursement Arrangement (rHRA) directly and efficiently addresses this need. Funded upon retirement, the rHRA helps bridge the gap between retirement and Medicare eligibility by providing tax-free funding for medical expenses. Special forms of compensation such as unused sick and vacation pay can be used to fund the rHRA, which means the employer is simply using existing earmarked funds more efficiently.

You can further incentivize early retirement by creatively structuring your HRA. For example, you could offer a certain contribution amount for

individuals who waive access to employer-sponsored health insurance or offer a larger lump sum contribution to employees committing to an early retirement decision in writing. The flexibility of the HRA allows you to design it based on the specific issue you need to solve.

rHRA at a glance

- Early retirement incentive

- Bridges gap between retirement & Medicare eligibility

- Can be funded using accumulated leave

- Triple tax free (tax-free contributions, growth and reimbursements)

- Flexible plan design means HRA can be structured to meet your specific needs

Attracting and Retaining Talent to Combat Too Much Attrition

In other cases, there may be instances of too much attrition. Organizations have always struggled with employees leaving in pursuit of higher pay, advancements, or family moves. Now, in today’s climate, this issue may be exacerbated by an increased health risk to employees with compromised immune systems or who are over age 60; the fear of adapting to a new set of challenges once onsite classes resume; or overall reduction in job satisfaction. According to a recent USA TODAY/Ipsos poll, 1 in 5 teachers are not likely to return to work. For those over age 55, it’s 1 in 4. However, with creative solutions, employers can offset some of the unwanted attrition.

Offer a Retention Incentive

If your organization is faced with a potentially damaging workforce reduction, the defined contribution HRA (dcHRA) can serve as an incentive for current employees to stay as well as a reason for jobseekers to choose you. Funded while the employee is actively working, the dcHRA can allow plan factors such as a vesting schedule, which incentivizes employees to stay with their employer until they are fully vested in their benefit. Additionally, opting to make a defined annual contribution into the employee’s plan versus a retirement-based defined benefit is a more attractive option that employees can immediately see. As the employer, you would make a tax-free contribution each year into the employee’s dcHRA. Funds are invested for potential tax-free growth and can be used tax-free post-employment by the employee, their spouse and eligible dependents.

dcHRA at a glance

- Retention tool

- Attracts talent

- Can be funded using accumulated leave

- Vesting schedules can apply

- Triple tax free (tax-free contributions, growth and reimbursements)

- Flexible plan design means HRA can be structured to meet your specific needs

Through these uncertain times, we can work with you to determine a path forward that not only saves your organization money but grants you peace of mind.

To learn more, click the link below that best fits your organization’s current need.

Click here to learn more about attracting and retaining talent to combat attrition.

Click here to learn more about avoiding layoffs through strategic buyout strategies.

A message from MidAmerica’s CEO, Jim Tormey

Like most employers, we at MidAmerica needed to take decisive action in a time of great uncertainty to protect our employees from the threat of COVID-19. But guided by our Mission—to take care of those public sector workers who take care of our communities—our teams rallied in record time, bringing us to a productive, fully remote environment in just one week.

As I’ve reflected on some of the successes and challenges MidAmerica has faced over the past three months, I’ve come to believe that we’ll never go back to how things operated before the pandemic hit. While that’s not necessarily a bad thing, it certainly shifts the landscape of how we must operate to effectively take care of our employees and those we serve. In that vein, I offer some insights gleaned from our experience with COVID-19. It’s my hope that our stories help employers, in both the public and private sectors, keep their employees safe, happy, and engaged as we adjust together to the new normal of a post-pandemic world.

1. The transition to remote work can be a non-event if leaders proceed with a Mission First mindset.

Like many, I initially worried about maintaining productivity in a fully remote work environment. Would employees remain motivated to stay on task without in-person accountability driven by a manager? Would they make the effort to connect with their teammates on critical collaboration tasks? I soon discovered my concerns to be unfounded. Any mission-driven organization naturally selects for the type of employees—at all levels—who exhibit intrinsic dedication to the organization’s shared values. These values, in turn, are a powerful motivator to drive accountability to tasks and performance standards, regardless of leadership’s physical presence in the workspace. At MidAmerica, all the logistical trappings of the remote work transition, from check-in cadence to ad-hoc problem-solving methods, naturally sorted themselves out over the course of the first few weeks working remotely. Buoyed by the critical nature of our Mission—more important in tough times than ever before—our team stepped up to the changes imposed by COVID-19 without skipping a beat.

2. Take good care of your employees; they will in turn take good care of your customers.

In challenging economic times, employers of all stripes seek budget savings wherever they can be found. Headcount reduction through layoffs is an obvious, albeit painful way to generate needed savings. But when considering layoffs, employers must balance the short-term savings they generate with the long-term impacts they may leave behind. Layoffs can be costly and, if not handled properly, can devastate morale and leave companies scrambling to cover critical responsibilities, both for day-to-day tasks and more strategic initiatives. We’ve seen voluntary separation incentives act as an ideal solution— especially in the public sector—to drive people cost savings while helping employees transition securely to the next chapter of their lives. But if layoffs become inevitable—as they were, unfortunately, at MidAmerica, take the time to fully understand both short and long-term cost impacts before proceeding. Most importantly, ensure that special attention is paid to facilitating a smooth and dignified process should employees need to be let go. Carta’s approach to this is a great place to start for those who may need to conduct layoffs remotely.

3. Strong cultures can continue to thrive remotely—and are imperative for keeping morale and productivity high.

The challenges of remote work, along with rapid changes to long-established procedures, can be taxing for seasoned employees accustomed to in-office interaction and routines. Feelings of isolation and collaborative difficulties are widespread in both the private and public sectors; a USA Today poll indicated 1 in 5 teachers are considering not returning to their classrooms come the new school year in Fall. In the work-from-home environment, it is more critical than ever that employees feel connected, engaged, and valued in their work. Small niceties and non-work activities can go a long way toward bridging the human connectivity gap, and toward retaining employees who might be considering departing the organization. We’ve found great success with our “Winning Wednesdays” program—a 15-minute trivia break each Wednesday afternoon that breaks up the work week and gives people a chance to interact with folks across the entire organization. We’ve also kept our employee recognition programs going strong with customized gift baskets and hand-written notes delivered directly to employee homes. Proactive efforts to preserve culture don’t need to be architected, complicated, or even expensive; they simply have to resonate authentically with the members of our teams.

4. Be mindful that some employees may need help adapting to the new realities of work.

With many companies considering long-term remote work arrangements for the first time in their history, new territory is explored daily regarding how employers should operate for sustainable success away from the traditional office. But with so much focus accorded to preserving efficiency and productivity when working from home, it is easy to lose sight of employees navigating the uncharted waters of a newly blended workplace and home. Instead, double down on listening to your employees and understanding their concerns individually—we’ve used regular companywide pulse surveys and 1:1 videoconference meetings to understand what’s going well and what’s challenging for employees. Be flexible to the maximum extent possible in accommodating their needs and allaying their fears. Policies like flexible on-demand paid time off (PTO), alternate work hours, stipends for newly-incurred work expenses, and even celebrating “guest star” appearances of spouses, children, and pets have helped our teams feel confident in managing the massive quantity of change that all of us have encountered. We’ve always encouraged our employees to bring their whole selves to work, and that commitment continues even as our workplaces have shifted to the home.

Amidst all the uncertainty in the world, our employees and communities are looking to us for guidance and leadership. Few courses of action in the COVID-19 pandemic are so simple as to please everyone, or so certain as to guarantee successful outcomes given all the change that is yet to come. But with our Mission as our North Star and our Core Values as our compass, MidAmerica has remained consistently ready to deliver on our commitment to our communities and those who serve them. There will no doubt be difficult choices ahead, and consensus on the best way forward may be elusive. But decisions made in line with the Mission and Values ensure that, no matter the ups and downs, we will find the best possible solution for continued safeguarding of our employees and all those who depend on us.

Click here to download this blog as a PDF.