Offsetting rising health care costs is a struggle for many employers. A Health Reimbursement Arrangement (HRA) is a cost-effective way for employers to provide great health benefits to employees at a reduced cost. An HRA is an employer-funded health benefit plan that reimburses employees for out-of-pocket medical expenses and health insurance premiums on a tax-free basis.

At MidAmerica, we offer three flexible HRA options, so you can make sure the benefit offered to employees meets the needs and goals of your organization:

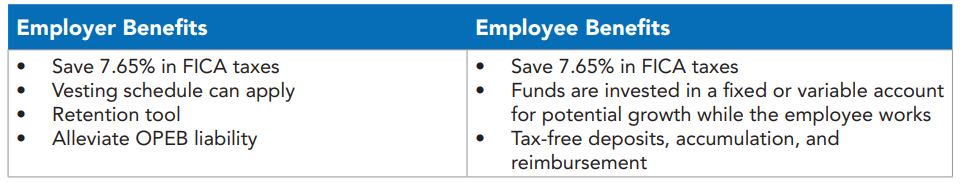

dcHRA

A defined contribution HRA (dcHRA) offers a quantifiable retirement benefit that reduces the employer’s OPEB liability while attracting and retaining top talent. It allows employers to deposit a fixed dollar amount into the HRA while the employee is actively working for use upon retirement or separation of service. Funds can be used to reimburse eligible medical expenses for the retiree, their spouse, and eligible dependents on a tax-free basis. Funding the plan during employment allows for managed cash flow and potential asset growth as well.

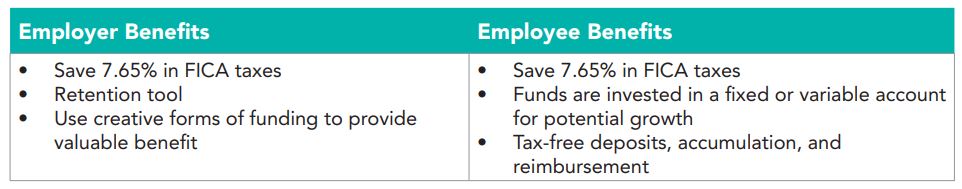

rHRA

A retiree HRA (rHRA) helps bridge the gap between retirement and Medicare eligibility for employees. An rHRA accomplishes this by using unique sources of funding like unused sick leave and unused vacation pay, or other incentives into an employee’s account at retirement. Funds can be used upon retirement or separation of service to reimburse eligible medical expenses for the retiree, their spouse, and eligible dependents.

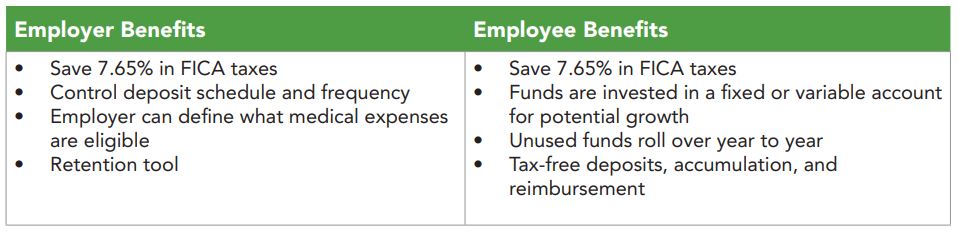

iHRA

An integrated HRA (iHRA) helps employers offset the cost of group medical coverage for active employees by depositing a fixed amount into the employee’s HRA. Funds can be used to reimburse eligible medical expenses, such as deductibles, and are available immediately upon contribution. This allows the employer to offer lower premium plans with higher deductibles without increasing the cost to the participant. In other words, this solution makes health care plans more affordable for both the employer and employee.

No matter what the health care benefit goal of your client is, it’s likely there is an HRA solution that can help them reach it. With flexible applications that help both the employer and employee, it’s a win-win plan for all.

Not sure which HRA plan is right for your organization?

Schedule a free consultation: